-

Address

1624 Locust St., 5th Fl

Philadelphia, PA 19103 -

MedAbode Real Estate

As it is for anyone, buying a house as a medical professional is a very important decision. As such, it is important for you to take all precautions and do all the diligence necessary prior to closing. Buying a house can be time consuming and it can also be a little stressful as well. However, the process can also be fun and with a little advance planning, you won’t have to feel like you’re under pressure when buying a house. The following tips will keep you sane and safe as start the process to own a home.

Buying a house is a life-time investment and you shouldn’t do it in a rush. Take your time to ensure you are ready for that big step.

If you want to reduce stress when buying your first home, make sure a a real estate agent is involved. This will help because the agent is experienced and informed about the market dynamics and how all pieces of the puzzle fit together.

There are many available mortgages with each having advantages and disadvantages. Make sure to study them carefully and choose the one that suits you according to your financial needs.

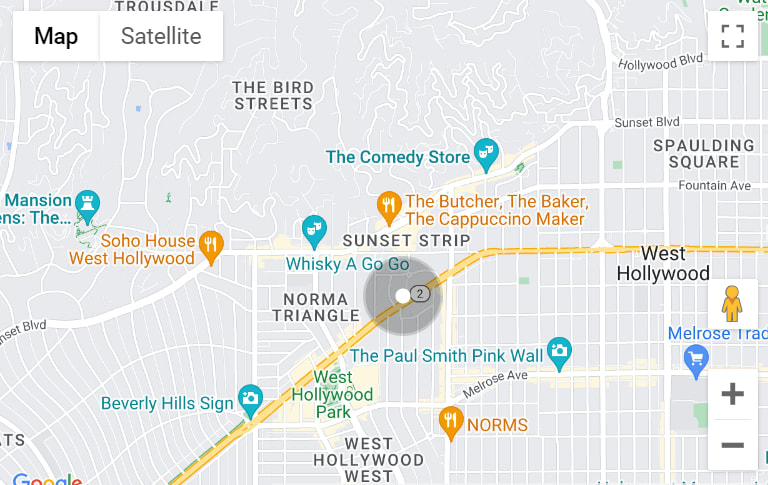

Where you buy your home might be the most important decision you make. You need to visit the location and ensure you are satisfied with it and are ready to live there.

Many times people only think about the cost of the home itself. We would recommend taking a broader view which would include paying moving costs, certain fees and expenses, utility costs at the new location.

It’s advisable to have some funds saved up. As a medical professional, you have huge advantages with respect to the down payment necessary to purchase your home. Talk to your real estate agent up front to be sure you understand how much you’ll need to put down on your home.

Enhance your credit score by paying all bills in a timely manner. Clearing your bills on time earns you favor from banks and gets be eligible for good interest rates.

When you set out to buy your first home you are going to get many offers and many choices. It is tempting to buy a more costly house that has all the features that you’re looking for. Avoid this pitfall by setting guidelines on price and be disciplined about what you can afford.

If you owe any money that you are able to pay back, focus on paying off those sums prior to applying for a mortgage. A better credit score and available financial capacity, can help you during the mortgage process.

Before you commit to signing the home purchase papers, have an idea of what you are looking for. Do your research and know what factors are most important to you and then figure out what the remaining nice-to-haves are. Failure to see what’s important to you can lead to you being dazed by the multitude of options across the large number of homes that are available.

It’s normal to be anxious when buying a home but don’t stress yourself with issues that you can prepare for. Using a real estate agent can help you move through the process with much less stress and aggravation.

You don’t have to go it alone because, at MedAbode Philly, we are devoted to help medical professionals purchase, sell and invest in properties in and around Philadelphia, PA. Don’t hesitate to contact us so that we can assist you.